We assist you in:

-

assessing and validating your thinking on China, drawing up a business plan, evaluating and advising on the most suitable structures, and establishing the branch/subsidiary/joint-venture in China

- Choice of location in China

- Structure of the company/legal form

- Optimization of group structure

- Capitalization of Chinese subsidiaries

- Preparation of application documents for Chinese authorities

-

acquiring Chinese companies (M&A)

- Valuation of the company and shareholdings

- Optimization of acquisition structure

- Preparation of contracts with legal advisors

-

day-to-day consulting in respect of your Chinese operations

- Advisory services in tax matters and annual accounting in China

- Transfer Pricing

- Expatriate advice

Choice of Location

The choice of the right location in China predominantly depends on economic factors (logistics, accessibility of and proximity to customers and suppliers). The stipulations and incentives of the different development areas should be examined when choosing the exact location within a region and by doing this, several benefits, for example in tax matters, can be obtained.

Optimization of Group Structure / Acquisition Structure

Many criteria need to be taken into account when designing a group structure with various overseas subsidiaries. One of the key objectives is to minimise the group’s tax burden.

In particular BDO can advise in respect of:

- withholding tax minimization

- tax deductibility of interest expenses and other acquisition costs

- minimization of capital gains tax (exit strategy)

- transfer pricing

Capitalization of Chinese Subsidiaries

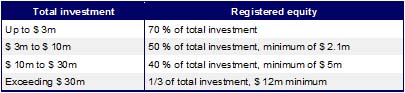

Chinese corporate law includes arrangements for the minimum capitalization of Chinese companies.

Current debt-to-equity ratios

The required level of third party capital can either be provided by an unrelated party (e.g. a bank) or structured as an intercompany loan. However, the latter might well become subject to restrictions regarding the tax deductibility of interest expenses in the future.

Tax Consulting and Annual Accounting in China

Our colleagues in BDO China will assist you with the day-to-day tax issues and annual accounting of your Chinese subsidiary.

Our services in China comply with BDO’s international quality standards.

Continuous cooperation with our Chinese colleagues in the audit and accounting department ensures an efficient process in respect of the audit of consolidated annual accounts.

Map of BDO office locations in China

The Services BDO offers in the Greater China Region:

- Audit

- Tax

- IPO and related advisory Services

- Financial and tax due diligence

- Outsourcing and accounting Services

Transfer Pricing

In international comparisons, China is no longer a low-tax country following the Chinese tax reform which came in early 2008. Thus, the determination of opportunities of transfer prices between group companies is very important. At the same time, the Chinese tax authorities continue to increase mandatory documentation requirements. We can support you in determining transfer prices and preparing necessary documentation.

We design our services to support your specific needs to help you to invest in China, please refer to our China Unlocked brochure for a roadmap.